Demat Account

It will not take more than 5 mins!!!

“If you would be wealthy, think of saving as well as getting.”

— Benjamin Franklin

The ABC of Demat Account

All you should know about it

What is Demat Account

A demat account (short for “dematerialized account”) is an account to hold financial securities (equity or debt) in electronic form. In India, demat accounts are maintained by two depository organisations, National Securities Depository Limited and Central Depository Services Limited. A depository participant, such as a bank, acts as an intermediary between the investor and the depository.

The demat account number is quoted for all transactions to enable electronic settlements of trades to take place. Access to the dematerialized account requires an internet password and a transaction password. Transfers or purchases of securities can then be initiated. Purchases and sales of securities on the dematerialized account are automatically made once transactions are confirmed and completed.

Why you need demat account

India adopted the demat account for electronic storing, wherein shares and securities are represented and maintained electronically, thus eliminating the troubles associated with paper shares. After the introduction of the depository system by the Depository Act of 1996, the process for sales, purchases and transfers of shares became significantly easier ; most of the risks associated with paper certificates were mitigated. It also helps to minimize the time of transfer of shares.

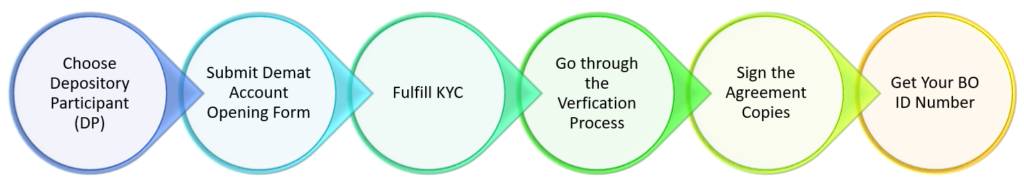

How to Open Demat Account

Your Demat Account is Just a click Away

Still wondering the advantages of having a Demat Account

The depository system reduces risks involved in holding physical certificates, e.g., loss, theft, mutilation, forgery, etc.

It ensures transfer settlements and reduces delay in registration of shares.

It ensures faster communication to investors.

It helps avoid bad delivery problems due to signature differences, etc.

It ensures faster payment on sale of shares.

No stamp duty is paid on transfer of shares.

It provides more acceptability and liquidity of securities.

No "odd lot" problem: even one share can be sold

Still Thinking ?

Your one small step to the financial investment will be giant leap in your financial growth and stability.